What are HMRC Tax Documents?

Her Majesty’s Revenue and Customs or HMRC is the official non-ministerial department of the UK Government, responsible for tax collection, payment of national minimum wages, issuance of national insurance numbers and other forms of state support. In the UK, different bodies are required to file tax returns with the HMRC, based on their liability for taxation. This includes non-UK residents, subject to UK taxable income laws.

If an individual is liable to report their income to the HMRC, the tax filing has to be completed by October 5, following the end of the relevant tax year. October 31 is the deadline for tax returns to be submitted for paper returns and January 31 is the deadline for online returns.

There are several documents, related to taxation, issued by the HMRC, based on the tax law and paying entity:

- SA100: Income tax paid by individuals

- SA900: Trusts and estates of deceased persons

- P60: Document showing the amount of tax paid on your salary in the previous tax year

- P45: Tax document issued by the employer when you stop working for them

- SA800: Tax paid by partnerships

- P35: Deductions towards “PAYE” and National Insurance contributions made by employers

- P11D: Document through which the employer conveys to the HMRC about your “benefits in kind,” such as interest-free loans or company cars

- CT600: Corporation tax paying companies

- VAT100: For Value Added Tax deductions

These HMRC issued tax documents need legalisation before they can be used for business transactions or employment applications abroad. For instance, many non-UK residents working in the UK will need legalisation of the P60 document to serve as proof of earnings and employment, if they would like to avoid double taxation in their home country. In a similar manner, UK citizens will need to legalise HMRC tax documents, such as P45, in order to serve as proof of employment and taxation in a foreign country, where they have been offered employment.

Corporate entities will also need legalisation of their HMRC tax documents to participate in foreign contractual negotiations, legal proceedings, property purchase or registration with local regulatory authorities.

Legalisation of HMRC tax documents is completed by the UK Foreign & Commonwealth Office (FCO), which is the sole authority to attach the apostille certificate to these documents. Apostille is a special form of legalisation, which gives public documents legal authenticity to be used in other countries.

The UK is a member of the 1961 Hague Convention, therefore public documents such as HMRC tax documents are acceptable by all other member nations of the convention as they bear the FCO apostille stamp. This convention abolished the requirement for consular legalisation of public documents to be used for cross-border purposes among signatory countries. However, if the country where the document has to be used is not a member of the 1961 Apostille Convention, the HMRC tax documents will require legalisation by the respective Embassy in London, after FCO apostille certification.

It is also to be noted that the FCO requires verification and attestation of certain documents by an accredited notary public or solicitor in the UK, before it attaches the apostille stamp.

Please see the process as below that we follow:

STEP 1

Send Us the

Original Document

STEP 2

We quality check

documents internally

STEP 3

The document is

solicitor certified and then

Apostilled 24 hours.

STEP 4

If required, we take the

document to the required

embassy for legalisation

STEP 5

Documents Returned

Back to you Domestically

or Internationally

HMRC Tax Documents

Legalisation

Processing Time: Please see pricing page

Pricing: Please see pricing page

Please use the dropdown menu’s for your document requirement. The pricing and document type will be generated after pressing the button below. Please note that to complete your order you will need to use the dropdown menus per document order. After the pricing table, you will then be taken to our order page. Following this you will be sent to our upload page to upload the documents which you can also complete later.

Service Inclusions:

- Solicitor Stamp

- FCO Submission and Collection

- Embassy Legalisations

- Precheck of documents

- Free Resubmissions

- Same Day Send Out

Start Legalisation Order

The button above will redirect you to our legalisation order form via our main RLS website. You will be able to select your service, your return address and method and make payment via it.

After making your order, we advise you contact our legalisation consultants by emailing your requirement to: applications@rapid-visas.co.uk.

Conclusion

Tax returns are vital official documents, required for many types of foreign business transactions and employment formalities. They act as proof of a company’s or individual’s tax liability, employment and serve as proof of good citizenship if necessary.

The HMRC is the official body in the UK that processes, collects and accepts tax return filings from corporate entities and UK-based employees. Various types of HMRC tax documents need legalisation by the UK FCO and the nation’s embassy in London, for application of business visas, employment visas and official visit visas, drafting of legal documents, avoiding double taxation in other jurisdictions.

Legalisations.org.uk has years of experience with legalising documents to be used abroad. We work with a large network of expert agents, lawyers, solicitors, consular and government officials to provide legalisation services with the fastest turnaround times. You can trust our vetted agents to take care of your important company and individual tax documents. They will also carry out detailed pre-checking of documents to ensure that they are in the format prescribed by the FCO and the Embassy.

You can email us at info@legalisations.org.uk with all your queries and requirements, or call us at 0845 224 9482. Please fill this contact form, and one of our representatives will get back to you.

The Most Common Documents We Legalise

Standard Personal Documents

- Birth, Marriage, Death Certificates

- HMRC letters

- ACPO, ACRO, Police Letters

- No Impediment Certificate

- Court Documents

Corporate Business Documents

- Incorporation Certificate

- Appointment Reports

- Mem & Arts

- Company Letters

- Companies House Certs

- Minutes & Resolutions

Educational Documents

- Degree, Masters, Diploma

- GCSE, CSE, O Level

- Professional Qualifications

- Training Certificates

- Transcripts & Reports

- School Letters

Frequently Asked Questions

To get your HMRC tax documents apostilled by the UK FCO, submit them to Legalisations.org.uk. Our agents will take care of all the requirements, including booking appointments with the legalisation offices at the FCO and the Embassy, where required, followed by submission of your documents as well as collection after the process is completed.

The process followed for the legalisation of tax documents is as follows:

Step 1: The process begins with you informing us of your document legalisation needs by sending us an email at info@legalisations.org.uk. We will then advise you on the further steps and quote our fees. You can also get in touch with us at 0845 224 9482.

Step 2: You can send your documents to us through courier or submit them personally at our office in London. Send the documents through UPS or DHL international delivery, if you are not residing in the UK.

Step 3: Our agents will submit the documents to the FCO legalisation office in Milton Keynes, London. If the documents need prior notarisation, our in-house solicitor will take care of that.

Step 4: The FCO will take a day or two to attach an apostille certificate to the HMRC tax documents. You can choose our same-day service package for urgent purposes. Our agents will collect the documents whenever the process is completed from the FCO office.

Step 5: If your document requires further Embassy legalisation, our agents will submit the documents to the respective consular office in London for further processing. All the documents will then be sent back to you safely, either through courier or in-person at our office.

To attach the apostille stamp, the UK FCO charges a fee of £75.00 per document. Our service charges are £105.00 + VAT for the Standard package, in which you will receive the legalised documents within 6 business days. For the Express package, we charge £135.00 + VAT, which ensures delivery within 2 business days.

Note that the service charges are inclusive of our in-house UK solicitor fee.

Legalisations.org.uk is committed to providing you the most efficient services at competitive rates, in order to make the entire process efficient.

Send us your documents through courier services, such as Royal Mail or special delivery services, to our office address in London. You can also choose to personally drop the documents off at our office.

Even if you are not currently residing in the UK, we will take care of all your legalisation requirements. Send us the required documents through UPS or DHL international courier services.

We recommend that you send us a scanned copy of the documents through email before you courier them. This helps us check that we have received the right documents and prevents any unnecessary delay in the process.

Please note that some countries require apostille legalisation by the FCO for HMRC tax documents, along with consular legalisation. We would recommend confirming whether the destination country is a member of the 1961 Hague Convention. If they are not a part of the 1961 Hague Convention, consular legalisation will be mandatory for your documents, which would require more time.

The UK Foreign and Commonwealth Office (FCO) has the sole authority to verify that the UK public official’s signature, seal or stamp on your tax documents are authentic. After this verification, the FCO issues the apostille certificate and stamp on the reverse of the original HMRC tax documents.

Since the UK is a member of the 1961 Hague Apostille Convention, the apostille stamp alone will suffice for the document to be considered legal for foreign transactions in any of the other signatory countries. However, if the destination country is not a member of this convention, the HMRC tax documents will need to be further submitted to the respective embassy in London for legalisation. This will be completed by the consular or legalisation department at the Embassy.

Please remember that the FCO will issue the apostille certification, only when the documents have been attested by a notary public or solicitor in the UK.

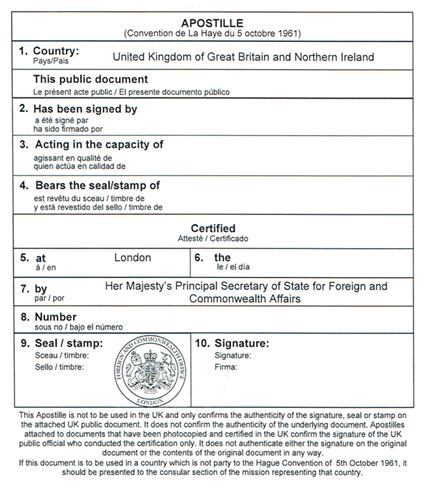

While various nations have their own designs for apostille certificates, the UK apostille is an A-5 size sheet attached to the back of the original document permanently. There are typically 10 sub-sections in this certificate:

- Country: The United Kingdom of Great Britain and Northern Ireland

- Has been signed by: Solicitor or UK FCO official

- Acting in the capacity of: The official’s capacity as an authorised signatory

- Bears the seal/stamp of

- At London

- The date of issue

- By Her Majesty’s Principal Secretary of State for Foreign and Commonwealth Affairs

- Number: The registration number or document identification number

- Seal/stamp: The red seal bearing the government crest is attached here.

- Signature: The issuing officer will put their signature here.

After the apostille certificate is attached, a red seal, bearing the UK Government’s crest, will be embossed on top of the document. This is the apostille stamp, without which the process would be incomplete.